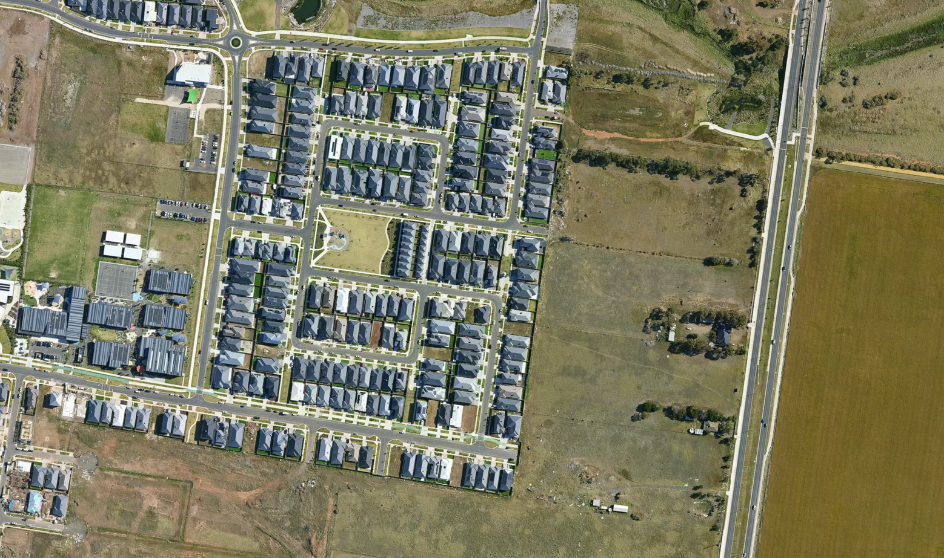

Use high-resolution aerial imagery to evaluate property exposure to hazards like flood, fire and environmental risks. Gain a complete view of properties in context to support underwriting decisions and identify potential risks early and accurately.

Confirm property conditions and detect inconsistencies with current and historical aerial imagery. Support fair claims processing and reduce fraud by verifying damage and changes remotely, cutting investigation time and costs.

Remotely assess building features, construction type, and condition with precise aerial data. Facilitate quicker post-event damage evaluations and enable faster claims resolution, improving client satisfaction.

Access recent aerial imagery to streamline quoting and underwriting workflows. Reduce the need for site visits by remotely assessing properties, improving quote accuracy and turnaround time.